Optometry Practice Finances: A Complete Guide to Building a Profitable Practice

The average optometry practice loses $150,000 annually to preventable financial mismanagement. Understanding optometry practice finances is the difference between a thriving practice and one that struggles to keep the lights on. Whether you’re launching a new practice or optimizing an existing one, financial mastery determines your success more than clinical excellence alone.

Table of Contents

- Why Do Optometry Practice Finances Demand Your Attention?

- What Core Financial Metrics Must Every Practice Track?

- How Do You Build Your Revenue Foundation?

- How Do You Control Expenses Without Cutting Quality?

- Why Is Cash Flow the Lifeblood of Your Practice?

- What Tax Planning Strategies Work for Optometrists?

- How Do You Finance Growth Intelligently?

- Which Technology Investments Pay Returns?

- How Do You Create Financial Projections and Budgets?

- How Do Financial Professionals Help Your Practice?

Why Do Optometry Practice Finances Demand Your Attention?

Most optometrists graduate with exceptional clinical training and minimal business education. This knowledge gap creates real problems. A 2024 survey by the American Optometric Association found that 67% of practice owners feel unprepared to manage their practice finances effectively.

The consequences show up everywhere: inconsistent cash flow, surprise tax bills, equipment purchases that strain the budget, and staff compensation structures that either bleed money or fail to retain talent.

Here’s the reality: optometry practices operate on thinner margins than most healthcare specialties. The typical practice runs at 25-35% profit margins when managed well, but poorly managed practices often drop to single digits or operate at a loss while the owner remains unaware.

Understanding your numbers isn’t optional. It’s survival.

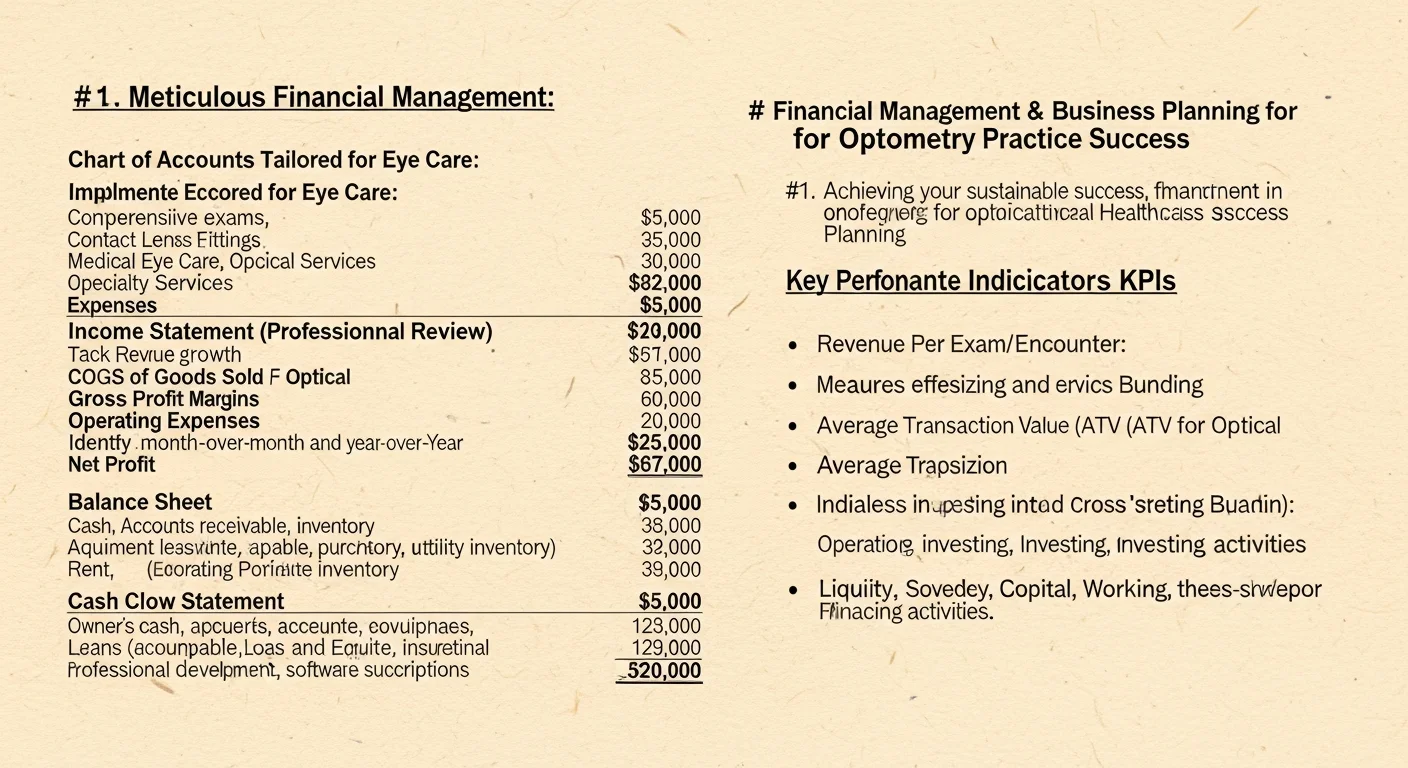

What Core Financial Metrics Must Every Practice Track?

Before diving into strategies, you need clarity on what to measure. Successful optometry practice finances management starts with tracking these essential metrics:

How Do You Calculate Revenue Per Patient Visit?

Calculate this by dividing total revenue by total patient visits. The national average sits around $285 per comprehensive exam visit, but top-performing practices achieve $350 or higher by optimizing their optical capture rate and medical billing.

If your number falls below $250, you have a revenue problem that requires immediate attention.

What Is a Healthy Optical Capture Rate?

This percentage shows how many patients who receive a glasses prescription actually purchase eyewear from your practice. The industry average hovers around 60%, but well-run optical departments achieve 75% or higher.

Each percentage point increase in capture rate can mean $15,000 to $30,000 in additional annual revenue for a typical practice.

Cost of Goods Sold (COGS)

Your optical inventory and contact lens costs should stay between 25-35% of optical revenue. Practices that exceed 40% are either over-ordering inventory, failing to negotiate with vendors, or pricing their products too low.

Overhead Ratio

Total operating expenses divided by total revenue reveals your overhead ratio. Healthy optometry practices maintain overhead between 55-65% of revenue. Anything above 70% signals structural problems that will erode profitability.

How Do You Build Your Revenue Foundation?

Optometry practice finances improve when revenue flows consistently and predictably. Here’s how to build that foundation:

How Can You Maximize Medical Billing Revenue?

Many optometrists leave significant revenue on the table by failing to bill medical insurance appropriately. When a patient presents with dry eye, glaucoma, or diabetic retinopathy, that visit qualifies for medical billing at higher reimbursement rates than routine vision exams.

The difference matters: a routine exam might reimburse $80 from a vision plan, while a medical exam for the same patient with a diagnosis could reimburse $150 or more from their medical insurance.

Train your staff to identify medical conditions during intake. Update your billing codes quarterly to capture all legitimate revenue. Consider hiring a billing specialist or outsourcing to a healthcare billing service if your practice volume exceeds 30 patients per day.

When Should You Optimize Your Fee Schedule?

When did you last increase your fees? Many practices operate on fee schedules set years ago, while their costs have risen significantly.

Review your fees annually. Compare them against local competitors and national benchmarks. Most practices can increase fees 3-5% annually without patient pushback, especially when the increases align with improved service quality.

Practices that fail to adjust fees annually effectively give themselves a pay cut as inflation erodes the purchasing power of stagnant prices.

A systematic annual fee review process, ideally conducted alongside your CPA during budget planning, ensures your pricing keeps pace with rising costs for staff, supplies, and equipment.

Communicating fee adjustments to patients through improved service quality and new capabilities makes increases feel justified rather than arbitrary.

How Do You Reduce No-Shows and Cancellations?

Empty appointment slots cost money. The average no-show costs an optometry practice $175 in lost revenue. A practice with a 15% no-show rate loses over $50,000 annually.

Implement automated appointment reminders via text and email. Send reminders 48 hours and 24 hours before appointments. Some practices have reduced no-show rates to under 5% through consistent reminder systems.

Missed calls compound this problem. When potential patients call and reach voicemail, 47% never call back. That’s revenue walking out the door before it ever arrives.

How Do You Control Expenses Without Cutting Quality?

The expense side of optometry practice finances requires surgical precision. Cut the wrong things and you damage patient experience. Ignore bloated costs and you drain profitability. The most successful practice owners approach expense management as an ongoing process rather than an annual exercise, reviewing each cost category quarterly and comparing spending against industry benchmarks published by organizations like MGMA and the American Optometric Association. This regular review process catches cost creep before it becomes a profitability problem and creates accountability across the team for spending decisions that affect the bottom line.

How Do You Manage Staffing Costs?

Labor typically represents 25-30% of practice revenue. This includes salaries, benefits, payroll taxes, and training costs.

Analyze productivity metrics for each role. How many patients can your front desk team check in per hour? How efficiently does your optical staff convert prescriptions to sales? Identify bottlenecks and address them through training or workflow improvements before adding headcount.

Consider cross-training staff to handle multiple functions. A technician who can also assist in optical during slow periods provides more value than a specialist who sits idle.

Tracking revenue per staff member helps you identify where additional training could increase productivity and where additional hiring would generate a positive return on the compensation investment.

How Should You Handle Inventory Management?

Optical frame inventory ties up significant capital. Most practices carry too many frames, with slow-moving inventory gathering dust while cash flow suffers.

Implement an inventory tracking system that identifies your top sellers and your deadweight. The 80/20 rule applies: roughly 20% of your frames generate 80% of your optical revenue. Focus your investment there.

Negotiate with vendors for consignment arrangements on new frame lines. This reduces your risk when testing new products.

Regular inventory turns analysis reveals which frames sell within 90 days and which sit for six months or longer, allowing you to redirect capital from dead stock into proven sellers that generate faster returns.

When Does Equipment and Technology Investment Make Sense?

New diagnostic equipment feels exciting, but every purchase must justify its cost. Before buying that new OCT or fundus camera, calculate the return on investment.

Ask yourself: How many additional patients can I see? What new services can I offer? How much additional revenue will this generate compared to the monthly payment?

Lease versus buy decisions depend on your cash position, tax situation, and equipment obsolescence timeline. Consult with your accountant before major equipment decisions.

Why Is Cash Flow the Lifeblood of Your Practice?

Profitability means nothing if you can’t pay your bills. Cash flow management separates surviving practices from thriving ones because a practice can show strong profits on paper while simultaneously struggling to meet payroll or pay suppliers on time. This disconnect between accrual-based profitability and actual cash availability catches many new practice owners off guard, especially during their first year when insurance reimbursement cycles are still being established and patient volume remains unpredictable.

How Does the Cash Flow Cycle Work?

Revenue recognized is not cash received. When you see a patient and bill their insurance, weeks or months may pass before payment arrives. Meanwhile, you’ve already paid your staff, your rent, and your suppliers.

Map your cash flow cycle carefully, documenting exactly when major expenses hit throughout the year. Quarterly estimated taxes, annual insurance premiums, equipment lease payments, and seasonal inventory purchases all create predictable cash demands that you should plan for well in advance. Build reserves specifically to handle these predictable drains so they never create an emergency situation that forces you into expensive short-term borrowing or delays vendor payments that damage important supplier relationships.

How Do You Accelerate Collections?

Reduce your accounts receivable days. The faster money moves from insurance companies and patients to your bank account, the healthier your practice becomes.

Submit claims within 24 hours of service. Follow up on unpaid claims at 30 days, not 60. Collect patient portions at the time of service whenever possible.

The cost of delayed follow-up extends beyond individual transactions. Slow collections create a compounding cash shortage that limits your ability to invest in growth.

How Much Cash Reserve Does Your Practice Need?

Every optometry practice needs a cash reserve covering 3-6 months of operating expenses. This buffer protects you from seasonal slowdowns, insurance payment delays, or unexpected equipment failures.

Build this reserve gradually. Set aside 5-10% of monthly revenue until you reach your target. Treat this contribution as a non-negotiable expense, not something to fund “if there’s money left over.”

What Tax Planning Strategies Work for Optometrists?

Taxes represent one of the largest expenses in optometry practice finances. Proactive planning reduces this burden legally and significantly.

Many practice owners leave tens of thousands of dollars on the table each year simply because they treat tax planning as an annual event rather than an ongoing strategy.

The difference between reactive and proactive tax management can equal 15% or more of your total tax liability, money that could be reinvested into equipment, staff development, or practice growth.

Why Does Entity Structure Matter?

How your practice is structured, whether as a sole proprietorship, LLC, S-corporation, or C-corporation, directly impacts your tax liability. Many optometrists operate under suboptimal structures simply because they never revisited their original setup.

S-corporation election often provides significant tax savings for profitable practices by allowing owners to split income between salary and distributions, reducing self-employment tax.

Consult with a healthcare-focused CPA annually to ensure your structure remains optimal as your practice grows.

How Do Retirement Contributions Reduce Your Tax Burden?

Maximizing retirement plan contributions reduces taxable income while building long-term wealth. Solo 401(k) plans or SEP-IRAs allow substantial contributions for practice owners.

In 2026, you can contribute up to $23,500 in employee deferrals plus additional employer contributions based on your compensation structure. For high-earning optometrists, this can shelter $60,000 or more from current taxation.

How Does Equipment Depreciation Save on Taxes?

Section 179 deductions and bonus depreciation allow you to deduct the full purchase price of qualifying equipment in the year of purchase rather than depreciating it over time.

Strategic equipment purchases in profitable years can significantly reduce tax liability while improving your practice capabilities.

How Do You Finance Growth Intelligently?

At some point, growth requires capital beyond what your current operations generate. Understanding financing options helps you make smart decisions that support expansion without creating unsustainable debt burdens.

The timing of growth financing matters as much as the source, because borrowing during periods of strong revenue growth positions you to service debt comfortably while practices that borrow during downturns face compounding financial pressure.

Practice Loans

SBA loans offer favorable terms for healthcare practices, with lower interest rates and longer repayment periods than conventional business loans. However, the application process requires substantial documentation and patience.

Traditional bank loans may close faster but often require personal guarantees and collateral.

Building a relationship with a local bank before you need financing gives you better terms when the time comes, because bankers lend most favorably to businesses they understand and trust.

Equipment Financing

Equipment-specific loans or leases use the equipment itself as collateral, often requiring no additional security. This preserves your cash and credit lines for other needs.

Compare total cost of ownership between leasing and buying. Sometimes the financing costs make leasing more expensive despite lower monthly payments.

Lines of Credit

A business line of credit provides flexibility for managing cash flow fluctuations. You only pay interest on what you use, making it ideal for covering short-term gaps.

Establish your line of credit before you need it. Banks lend most readily to businesses that don’t desperately need the money.

Which Technology Investments Pay Returns?

Not all technology spending improves optometry practice finances. Focus investments on systems that directly impact revenue or significantly reduce costs.

The most common mistake practice owners make with technology is pursuing features they do not need while neglecting fundamentals like reliable phone systems and efficient scheduling workflows.

Before evaluating any technology purchase, define the specific problem you are solving and establish measurable criteria for success.

A technology investment without a clear ROI framework is just an expense, and expenses that do not contribute to patient care or revenue generation deserve careful scrutiny before approval.

Practice Management Software

Modern practice management systems automate scheduling, billing, and patient communication. The time savings alone often justify the monthly subscription cost, but the real value comes from reduced errors and improved collections.

Choose software that integrates with your EHR and optical POS system. Fragmented systems create data silos and inefficiency.

Patient Communication Systems

Automated appointment reminders, recall notifications, and patient satisfaction surveys improve retention and reduce no-shows. These systems typically cost $200-500 monthly but generate returns many times that amount.

The key is ensuring patients actually reach your practice when they call back. Voice AI solutions now handle routine calls, schedule appointments, and answer common questions without requiring additional staff.

Online Scheduling and Intake

Patients increasingly expect to book appointments online. Practices offering online scheduling see higher booking rates, especially from younger patients.

Digital intake forms reduce front desk workload and improve data accuracy. Patients complete paperwork at home, arriving ready for their appointment rather than spending the first 15 minutes with a clipboard.

How Do You Create Financial Projections and Budgets?

Flying blind financially leads to poor decisions. Formal budgeting and projection processes keep your practice on track.

Annual Budgeting Process

Create an annual budget before each fiscal year. Start with revenue projections based on patient volume trends and fee schedules. Then allocate expenses by category, comparing against industry benchmarks and your historical performance.

Review actual versus budget monthly. Variances signal problems early, while you can still address them.

Growth Projections

When planning expansion, whether adding a provider, opening a second location, or launching new services, build detailed financial projections. Include startup costs, expected revenue ramp-up timeline, and ongoing expenses.

Stress-test your projections by modeling multiple scenarios. What happens if patient volume comes in 20% below expectations? Can your practice survive the slow period while the new initiative gains traction? Conservative projections that you exceed build confidence with lenders and partners, while optimistic projections that you miss erode trust and create unnecessary pressure on your team.

How Do Financial Professionals Help Your Practice?

Optometry practice finances benefit from expert guidance, and the return on investing in professional advisors typically exceeds the cost by a wide margin. Build relationships with professionals who understand healthcare practices specifically, because the financial dynamics of optometry differ significantly from other small businesses. Insurance reimbursement cycles, optical inventory management, equipment depreciation strategies, and the interplay between medical and vision billing all require specialized knowledge that general business advisors rarely possess.

Why Choose a Healthcare-Focused CPA?

Generic accountants may miss industry-specific opportunities. A CPA specializing in healthcare practices understands optometry billing, common deductions, and benchmark ratios for your specialty.

Meet quarterly, not just at tax time. Proactive tax planning throughout the year yields better results than scrambling in April.

When Should You Hire a Practice Management Consultant?

When facing specific challenges, whether declining profitability, operational inefficiency, or growth planning, a consultant brings outside perspective and industry expertise.

Choose consultants with optometry-specific experience. Generic business consultants may offer advice that doesn’t translate to healthcare’s unique dynamics.

The practices that achieve the strongest financial results share a common trait: they treat financial management as an ongoing discipline rather than a year-end exercise. Monthly financial reviews that compare actual performance against budgets catch problems early, when small course corrections can prevent large losses. Quarterly strategy sessions with your CPA identify tax planning opportunities that disappear if you wait until filing season. Annual benchmarking against industry data from the AOA and MGMA reveals whether your practice is gaining ground or falling behind relative to peers.

Building financial systems takes time, but each system you put in place compounds the benefits of the others. Accurate revenue tracking enables better budgeting. Better budgeting enables smarter investment decisions. Smarter investments generate higher returns that fund further growth. This virtuous cycle explains why financially disciplined practices consistently outperform their peers in both profitability and practice value.

Key Takeaways

Mastering optometry practice finances requires attention to multiple interconnected systems. Focus on these priorities:

-

Track the right metrics: Revenue per patient, optical capture rate, COGS, and overhead ratio reveal your practice health at a glance.

-

Maximize revenue before cutting costs: Medical billing optimization and fee schedule updates often yield faster returns than expense reduction.

-

Manage cash flow actively: Profitability means nothing without liquidity. Accelerate collections and maintain adequate reserves.

-

Plan taxes proactively: Entity structure, retirement contributions, and equipment timing decisions can save tens of thousands annually.

-

Invest in technology strategically: Systems that improve revenue or reduce labor costs pay for themselves. Shiny objects that don’t move key metrics drain resources.

-

Build your advisory team: Healthcare-focused CPAs and consultants provide expertise that generic advisors lack.

Financial mastery takes time to develop, but the payoff is substantial. Practices that manage their finances well generate higher incomes for their owners, provide better experiences for patients, and build lasting value that rewards years of hard work.

Start with one area. Master it. Then expand to the next. Within a year, you’ll wonder how you ever operated without this clarity.

Keeping every appointment slot filled starts with answering every call. Talk to our team about how MyBCAT helps optometry practices capture more patients and reduce revenue leakage.

Related Reading

Optometry Practice Staffing: Build Your Dream Team. Optometry Practice Location: How to Choose the Right Site. Essential Optometric Practice Equipment: A Complete Guide.